First the good news: I am happy to report that my surgery early in March was a complete success! Cancer free and pathologies negative. It has been a long battle for me, but failing has never been an option in my mind. I still have radiation to go, but for now, I’m feeling great and have rolled up my sleeves to defend the Massachusetts Film Tax Credits against H62.

You may recall that IMAGINE Magazine introduced Film Tax Credits to New England in the early 2000’s and I wrote the first definitive piece on why we should pass film tax credits in 2004. As soon as that issue of IMAGNE hit the street, my office got a call from the Governor Romney’s office asking for twenty copies. That changed the nature of our struggle. The rest is history, we were able to introduce legislation, educate all the elected class and pass the Massachusetts Film Tax credits in 2005; and we made them better in 2006!

Since our inception in 1998, film tax credits and growing this industry has been our #1 mission. We have been defending them ever since. It’s a 24/7/365 responsibility, which is why IMAGINE has a full time Director of Government Relations. We need to know where our elected officials stand on our issues all the time.

We have always known that overnight our main attraction of major productions, both studio and independent, to bring their work to our state can be challenged. A recent case in point is Connecticut when in late June in 2013 the Connecticut’s Film Office awoke one morning to find the state’s tax credits for film had been suspended for two years!

Many people do not understand what tax credits are designed to do. What they are not designed to do is easier to understand. Tax Credits are not designed to put money directly into government coffers. Period. The end! Why is it always judged on that misconception?

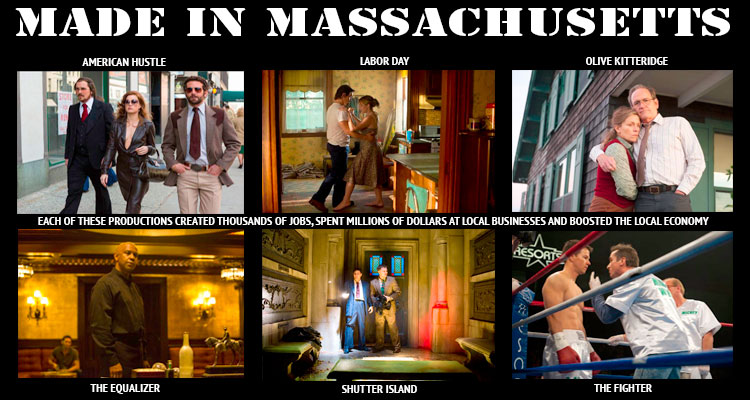

Tax Credits, and particularly Film Tax Credits, are designed to pour money into an existing economy; money that would not otherwise be available with the purpose of, in our instance, of creating an industry, stimulating job creation and other desired results that hugely benefit the Commonwealth. For example the Commonwealth could not afford to buy the attention, awareness and attraction of the really special visitors to our state, including the productions themselves that create the industry of tourism. Countless new businesses have arrived. I wish we knew how much collectively they paid the state to do business here.

When a production buys, rents or hires everything it needs here, cast and crew, talent trailers, equipment of all kinds, lumber, paint, hardware, hotel rooms, catering, transportation, waste management (yes, waste management, it’s a big ticketed item), chiropractors and much more, too numerous to mention, the desired results are achieved. The point being that every dollar the production spends ends up being business or personal income that will be taxed by the Commonwealth. In addition much of that money will be re-spent here creating more taxes for the state, cities and towns. Ultimately, all those dollars end up in a federal, state, or municipal coffer.

Consider this: As a result, Massachusetts has many very famous new taxpayers.

The film R.I.P.D spent a boat load of money here. Whether or not the film was a success or failure at the box office has nothing to do with the success of Tax Credits. The production was on location in and around Boston for six months, sometimes with five or six crews shooting at once. R.I.P.D. spent more than any other production in the Commonwealth’s history; they also didn’t break anything, they didn’t pollute or use any social services. They paid for everything before they left. Everyone who worked on R.I.P.D., no matter where they are from, paid taxes in Massachusetts! That includes Ryan and Bridges.

There is no exact formula for calculating the worth of a film tax credit. But, we are getting pretty close to being able to do that. I take great exception to being judged by anyone who apparently doesn’t understand what a tax credit is designed to do, particularly those who use the glamour of our industry to write head turning headlines, especially when they have no appreciation of the thousands of names in the credits at the end of the film, the countless businesses that provided services, or just how hard and yes, unglamorous, it is to make a film.

In my estimation there is no doubt we can prove our worth.

The next edition of IMAGINE puts a spotlight on this issue and we’ve designed a special section dedicated to our industry’s success and our importance to the state and region. I believe I am writing another definitive piece – a big one.

If you have an industry related business that began in MA after the tax credits were incepted or you are an individual that moved to MA or moved back to MA to work in this industry because of the tax credits, please drop me a note – I’d like to include your experience in our special section.

We are also focusing on NAB and the Massachusetts high tech industry that exhibits at NAB in Las Vegas April 11th – 16th. We’ll be there with a gigantic bonus distribution and huge presence. And we have Film Festival Previews for you.

If you would like to advertise in this edition please contact me. Ad Copy deadline is Monday, March 30, 2015. Please book space now.

Our latest edition of IMAGINE – the one that includes our New England Production, Resource and Location Guide is online. It isn’t too late to be a part on our online guide. You can do that by going to http://b19.a70.myftpupload.com/production-guide/submit-your-listing/ and if you haven’t renewed your 2015 subscription to IMAGINE in print delivered to your home or office visit www.imaginenews.com/subscribe.

Oh, yes, Happy Spring, and please feel free to forward this message to an interested friend.