Mar 16, 2018 | Imagine News, Industry Reports

Adaptive Studios, which recently rebooted HBO’s Project Greenlight with Matt Damon and Ben Affleck, has acquired the rights to Astral, a dramatic thriller digital series created by Canadian filmmaker and actress Sonja O’Hara. O’Hara (Amazon’s...

Nov 4, 2017 | Imagine News, Industry Reports, NE Film Festivals

By Vinca Liane Jarrett, Esq. If you’re not going to the Independent Television Festival, recently moved to Manchester, Vermont, the weekend starting Wednesday October 11, you’re probably either not in the know or you’re just not in the business, especially if you’re...

Mar 25, 2015 | Imagine News, Industry Reports

First the good news: I am happy to report that my surgery early in March was a complete success! Cancer free and pathologies negative. It has been a long battle for me, but failing has never been an option in my mind. I still have radiation to go, but for now, I’m...

Feb 25, 2013 | Imagine News, Industry Reports

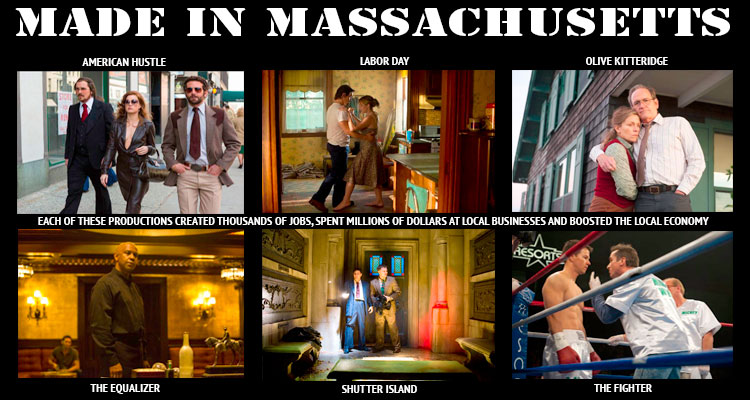

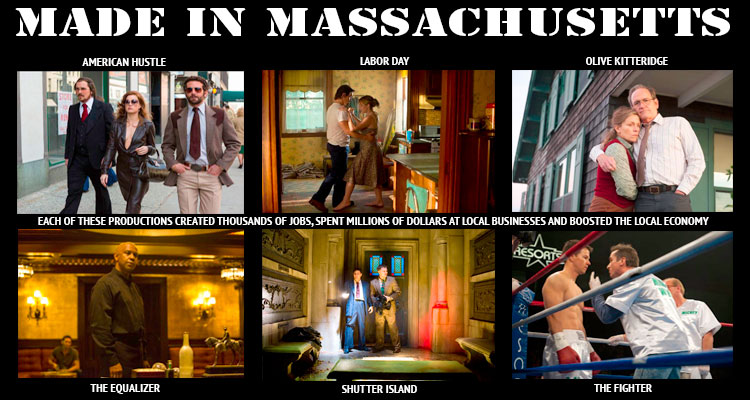

How New England stacks up against the competition By Emily McNamara, Esq. I’m seated mid-row in the overly air-conditioned auditorium of the Roosevelt Hotel in Hollywood. It’s Day 3 of a conference on “Film Financing” – State Incentives Day. Assembled on stage is a...

Nov 15, 2004 | Imagine News, Industry Reports

Earlier this year at AFCI 2004, I had the opportunity to meet with over 30 countries and many states in the United States to learn about the current status of their incentive programs designed to lure billions of movie production and telefilm dollars. It is clear that...